2006

Business founded in May 2006. Harrington Cooper partnered with several UK boutique asset managers to raise assets in the UK and Republic of Ireland

2008

Raised $150m for a sovereign debt fund at the height of the financial crisis

2009

Partnered with our first internationally based asset manager who we continue to work with today

2010

We provided consultancy and enabled the successful launch of a UCITS macro fund that mirrored an existing Cayman strategy. We subsequently raised over $1bn for the strategy in the coming years

2014

Partnered with a $100bn AUM US-based institutionally-orientated credit specialist. Harrington Cooper was hired to expand their presence in the wholesale market

2019

Reached $5bn of assets raised

Harrington Cooper was approved by the Japanese regulator

2020

Launched the Harrington Cooper Funds UCITS ICAV

Launched the HC Boston Common Global Impact Fund

2021

Launched HC Snyder US All Cap Equity Fund

What we do

Distribution

Asst raising within the high quality wholesale and institutional market across Japan, UK Europe and LATAM

Fund launches

Monitoring demand and identifying opportunities

Operating cross-border whilst cognisant of local regulation

Market research

Experience across multiple asset classes

Distribution

Consultancy

We can provide advice on areas including:

– Fund launches & repositioning, including UCITS

– Fund pricing, structuring & domicile

– Uploading to fund wraps and platforms

– Product marketability & demand assessment

Consultancy

Marketing & PR

Marketing plans, PR & media relations

Writing and designing promotional materials

Investment writing

Marketing & PR

Cross-border Coverage

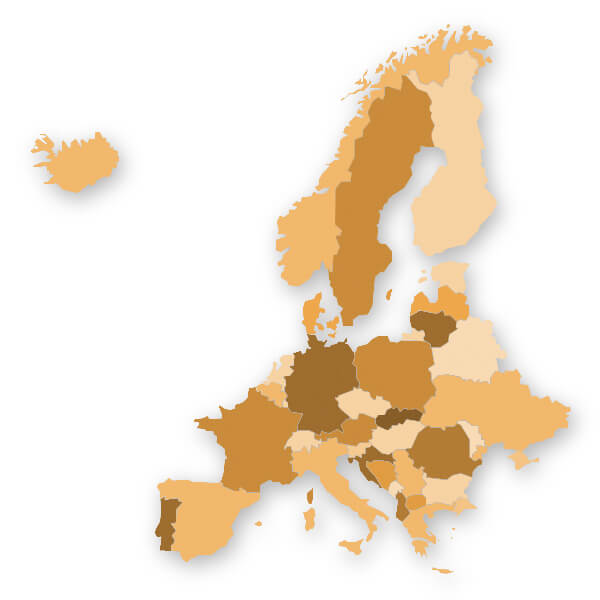

UK & Republic of Ireland

Continental Europe

Japan

Latin America

How we operate

Harrington Cooper partners with a select number of asset managers.

One full-time manager researcher ensure we partner with strategies that can fully withstand the scrutiny of gatekeepers.

We monitor and analyse asset allocation and investor demand in specific markets, which informs our search criteria and enables a targeted sales strategy.

Why Harrington Cooper?

Cross border coverage | Strong track record | Consultancy | Tailored approach | Transparent communication